Best Handyman Insurance | What You Need to Know

Most handyman services are sole-proprietors, one or two member LLCs, or Mom and Pop operations.

Although these may be considered small to mid-size operations, they face the same risks that other operations in the construction industry face, and as such, the handyman operation needs the same types of insurance policies to transfer their risk.

Easy Article Navigation

While many handyman services attempt to cover their risk by purchasing commercial insurance online, having an independent insurance agent with experience in the industry in your corner can make a huge difference and will not cost you a penny more for their expert services.

To find the best handyman insurance, here’s what you need to know to mitigate your everyday financial risks.

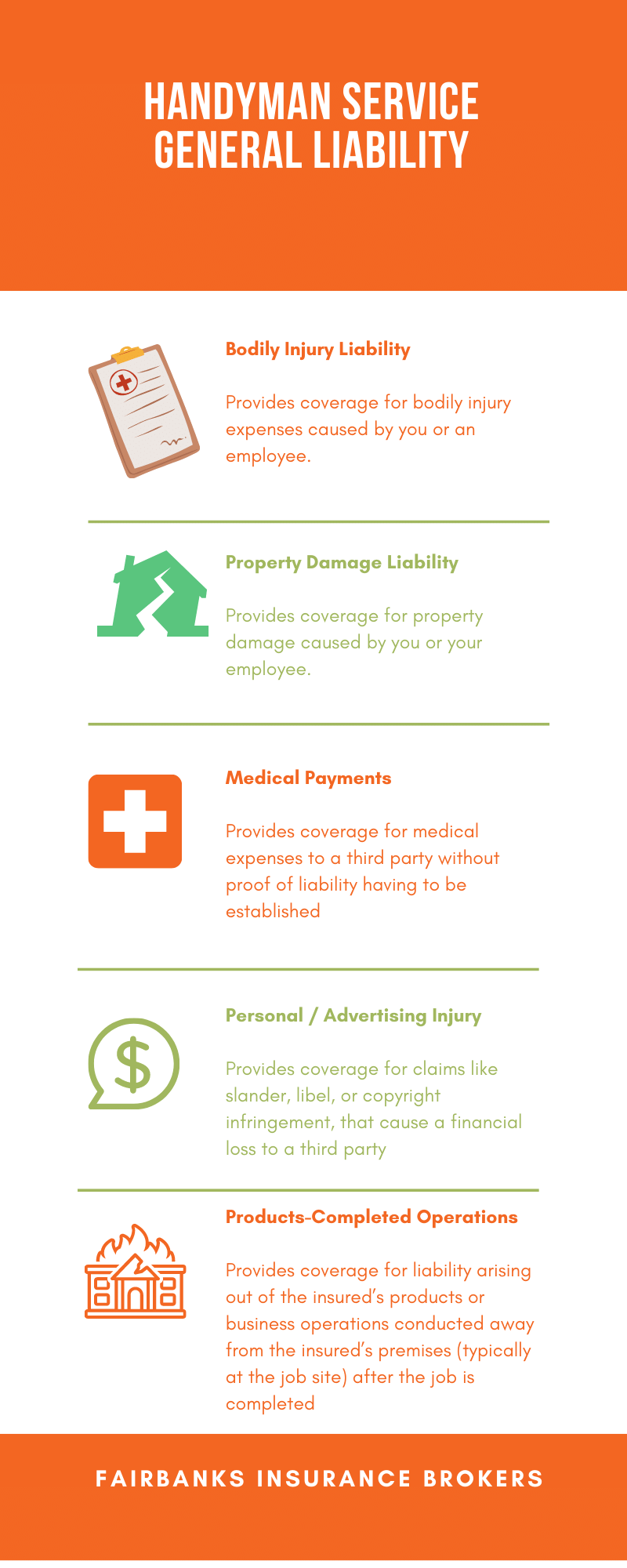

Handyman Insurance – General Liability

General liability insurance will serve as the foundation for your insurance package because most claims against a handyman service are for third-party bodily injury and property damage claims.

Your general liability will cover these types of claims and several more. Being covered means the insurance company will cover the defense costs if you or your business is sued by a customer or other third party and any financial judgment awarded by the court (up to the limits in your policy).

Here is what most general liability policies will cover:

The insured Handyman Service will also have coverage for defense costs if a claim leads to a lawsuit that must be settled in court.

Workers’ Compensation

Although your general liability policy will cover injuries to a third party, it will not cover job-related injuries or illnesses to you or your employees. These claims are only covered by a workers’ compensation policy.

Most states require handyman services to have workers’ compensation insurance even for a very small operation. If your state requires your handyman business to be licensed by the state, you should expect that a license bond and proof of workers’ compensation will be required to get that license.

Although in some cases, workers’ compensation premiums may be difficult to deal with, when you consider getting sued by an employee or having your state’s labor board fine and penalize your business for not having coverage, the premiums you pay will likely be a bargain.

Tools and Equipment Coverage (Inland Marine Insurance)

Having to replace all of your stolen or damaged tools can take a major hit to your bottom line.

Having an inland marine policy to cover your tools and equipment is an inexpensive way to mitigate the risk of having your important tools and equipment replaced in the event of a theft or other covered peril.

Your inland marine policy will cover losses to your tools and equipment while in storage, in transit, or on the job site.

Commercial Auto Insurance

If you are a handyman who is driving a van or pickup with your company name on your vehicle, your personal auto insurance will likely exclude coverage when your pickup or van is used for business.

Additionally, your personal auto policy may not provide the limits in coverage you need if you win a job with a large client or government agency.

To overcome this, you can purchase a commercial auto policy that will provide limits of up to $2 million and in many cases, will cost you less than your personal auto policy.

One Other Thing about Handyman Insurance

If your handyman service business provides professional advice to clients, you are open to the risk of professional liability claims.

Don’t take that chance! Professional Liability coverage is inexpensive and will cover you for damages if plans or professional advice results in a lawsuit.

If you’re not completely sure of the coverages you need, call or contact Fairbanks Insurance Brokers and find out what you need in terms of risk mitigation and how inexpensive it can be to protect you and your business.

Where Can I Buy Handyman Service Insurance?

The easiest way to get advice about and purchase Handyman Service Insurance is to contact a reputable and experienced insurance broker who represents all of the highly-rated companies that offer commercial insurance.

Fairbanks Insurance Brokers is a leading national insurance brokerage that is experienced in the construction industry and can discuss the coverages you need with authority.

Here is What We Recommend

General Liability: Contractors General Liability will be the foundation of protection for your business. The coverage will respond if you or your employees are found liable for bodily injury, property damage, or have a products/completed operations complaint. The coverage also covers defense costs for your business to respond to any lawsuits brought by a third party.

Workers’ Comp: Many states will require contractors to provide workers’ compensation coverage for their workers before they can begin a project. Accidents will happen at the job site that can result in an employee becoming injured and missing work. Your workers’ compensation coverage will provide financial assistance for medical expenses and lost wages.

Surety Bonds: It’s very likely that your state will require you to be licensed before you can begin operations. Most states and customers will require contractors to offer a license or surety bond before you are allowed to bid on a job or begin working.

Commercial Auto: Typically, most contractors will have light and heavy vehicles that require commercial auto insurance to make certain their vehicles can be repaired or replaced in the event of an accident, vandalism, or theft.

Tool Coverage: Also known as Inland Marine Insurance, this policy will provide for reimbursement for expenses to repair or replace tools and equipment. Your tools represent an important part of your livelihood, so we always encourage carpentry contractors to consider this valuable coverage.

Get A Quote