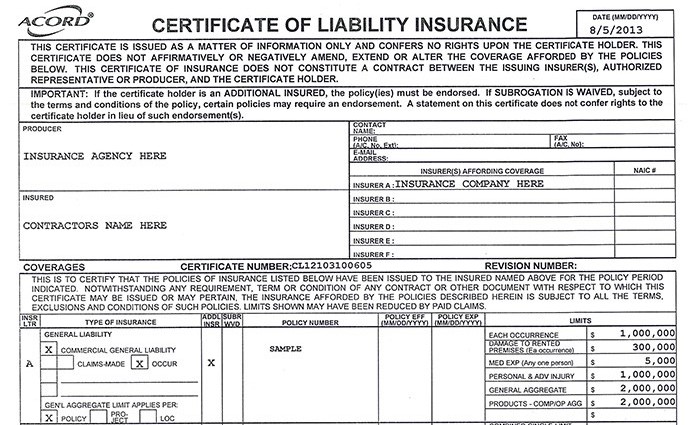

Certificate of Insurance – No Certificate, No Paycheck

As a specialty trade contractor, have you ever had a paycheck withheld or reduced because your GC didn’t have a record of your insurance coverage? This is a fairly typical situation. In most cases either the insurance broker didn’t get it delivered to the customer or the GC or customer didn’t keep track properly. In either case, it’s likely you won’t know there’s an issue until your paycheck is reduced or held up for insurance reasons.

If you are new to the contracting industry or not familiar with why these requirements are in place, read on so you can know what you don’t know.

Why You Must Supply a Certificate of Insurance

Most General Contractors do not provide workers’ compensation or general liability for their sub-contractors. It’s not because they can’t, it is because it doesn’t make financial sense for the GC or the sub. If you are covered under your GC’s workers’ compensation or general liability insurance, you will most likely be penalized for claims being paid on other sub-contractors which results in higher rates.

The only way your GC can be held not responsible for your insurance is by filing a certificate of insurance with their insurer on an annual basis. If, for example, you do not provide the certificate as requested, your GC’s insurance company will surcharge their policy because that company is at risk of having to pay claims for your sub-contractor business.

Audits Reveal Deficiencies

Typically, all workers’ compensation insurance companies have an audit completed before the annual renewal date and after a policy has been canceled. The purpose of the audit is to verify the risk to the insurer so they can charge an appropriate rate.

During the audit, if the insurer is not provided with a certificate of insurance from all subcontractors that were claimed on the GC’s tax return, the insurer will increase the workers’ comp insurance premium to provide coverage for the subcontractor.

It works the same way with general liability insurance although some insurers will provide coverage for sub-contractors as long as the total of the sub-contractors’ cost to the GC is less than 25% of the total revenue of the GC.

The Effect on Your Business

Although some GC’s will deduct their estimated cost for your insurance from your paycheck, the majority will simply hold the check until you have resolved the deficiencies. This situation could cause significant financial hardship for any business, especially when the payment is a large amount.

It’s tough enough waiting until the contract is completed to get paid, consider how much tougher it would be if you have to wait an additional month to get your certificates delivered.

How Can I Prevent This From Happening?

Knowing how important certificates are to your business, it makes perfect sense to do business with an insurance broker that considers insurance certificates a priority. Fairbanks Insurance Brokers understand how important your certificate is to you financially and always considers your certificates as a top priority. After all, outstanding service after the sale is necessary to have a long-term relationship with a client.

You, as the sub-contractor, need only to make certain to notify your insurance broker of your certificate requirements and to make sure your policy remains active with the insurer. Once your policy is issued, you need only to make timely payments to keep it in force.

For more information and a free commercial insurance quote, contact an insurance professional at Fairbanks Insurance Brokers at (949) 595-0284.

We have all the coverages you need to protect you and your business from everyday risks.

Here is What We Recommend

General Liability: Contractors General Liability will be the foundation of protection for your business. The coverage will respond if you or your employees are found liable for bodily injury, property damage, or have a products/completed operations complaint. The coverage also covers defense costs for your business to respond to any lawsuits brought by a third party.

Workers’ Comp: Many states will require contractors to provide workers’ compensation coverage for their workers before they can begin a project. Accidents will happen at the job site that can result in an employee becoming injured and missing work. Your workers’ compensation coverage will provide financial assistance for medical expenses and lost wages.

Surety Bonds: It’s very likely that your state will require you to be licensed before you can begin operations. Most states and customers will require contractors to offer a license or surety bond before you are allowed to bid on a job or begin working.

Commercial Auto: Typically, most contractors will have light and heavy vehicles that require commercial auto insurance to make certain their vehicles can be repaired or replaced in the event of an accident, vandalism, or theft.

Tool Coverage: Also known as Inland Marine Insurance, this policy will provide for reimbursement for expenses to repair or replace tools and equipment. Your tools represent an important part of your livelihood, so we always encourage carpentry contractors to consider this valuable coverage.

Get A Quote